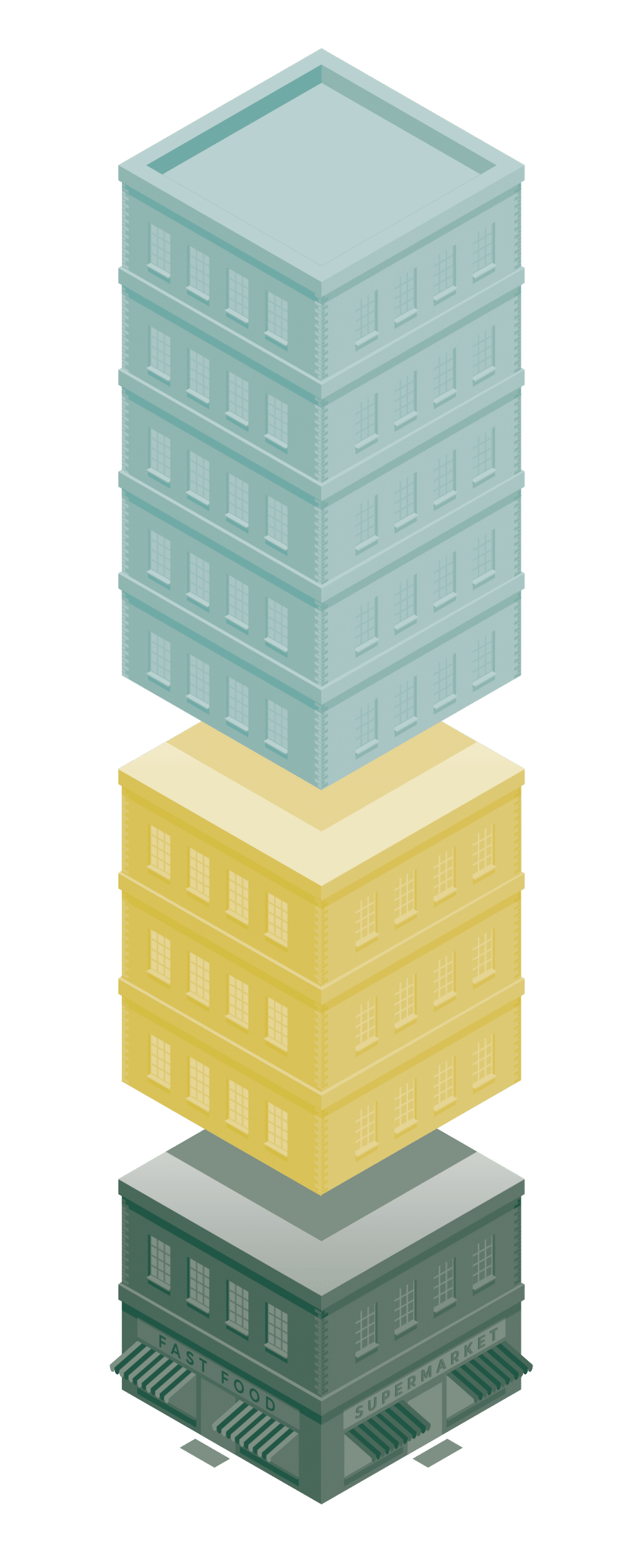

SENIOR DEBT

The majority of Stonehouse arrangements comprise of a combination of Senior and Stretch Senior Development Finance – the largest part of the capital stack and most cost effective for the real estate investor.

Over the last 5 years, the landscape has changed. A marketplace once dominated by UK clearing banks now sees challenger banks and alternative lending platforms playing a major competitive role in this element of the capital stack.

Stonehouse runs internal credit analyses to facilitate the preparation and presentation of each transaction and ultimately achiever a swift response from the appropriate senior debt provider.

MEZZANINE

Stonehouse enjoys relationships with a number of mezzanine providers already in possession of the appropriate intercreditor agreement with senior lenders. This approach expedites the transaction and what may be the intermediate phase of a capital structure. Prior to considering mezzanine financing, due to its costly and sometimes complicated nature with third party lenders needing to consider the negative scenario of a project failure, all senior stretch options are considered.

EQUITY

Equity finance plays an important part in real estate investing, and particularly in development projects. Most transactions involve at least two parties: the developer, who is also an active partner, and the equity investor. We work with a number of private equity providers and only select funds that we are sure can support our borrowers in their expansion and growth.

The starting point is always to analyse the transaction to ensure it is fundable before an appropriate equity option is put forward.